Individual’s tax 2016 (change)

Posted on July 10, 2017

Hello everyone,

We have been talking about this for a long time and we have already communicated our decision to several of our clients, but this letter is intended to formalize the transition we are making. As you know, Jean Gabriel, the team and I have been working hard during the tax season for 3 years to serve you. It is a race against the clock every year to make everything happen on time, in a storm of emails, calls and documents.

We work throughout the year to build an exceptional practice with our commercial clients. We want to offer them an unparalleled service, which is incompatible with additional pressure during two months of the year to satisfy in the same way more than 200 employees and self-employed, while we are already busy brimming for 12 months of the year.

For this reason, we decided to modify this part of our practice considerably, although we loved the interactions we had with you and know how much you like your accountant (Jean Gabriel, at least).

The new way

We decided to do tax clinics on specific dates to avoid the daily disruptions caused by the individual’s tax. We want to keep our focus on individual files at a specific time, instead of having to deal with a flood of follow-ups, e-mails, missed calls and appointments.

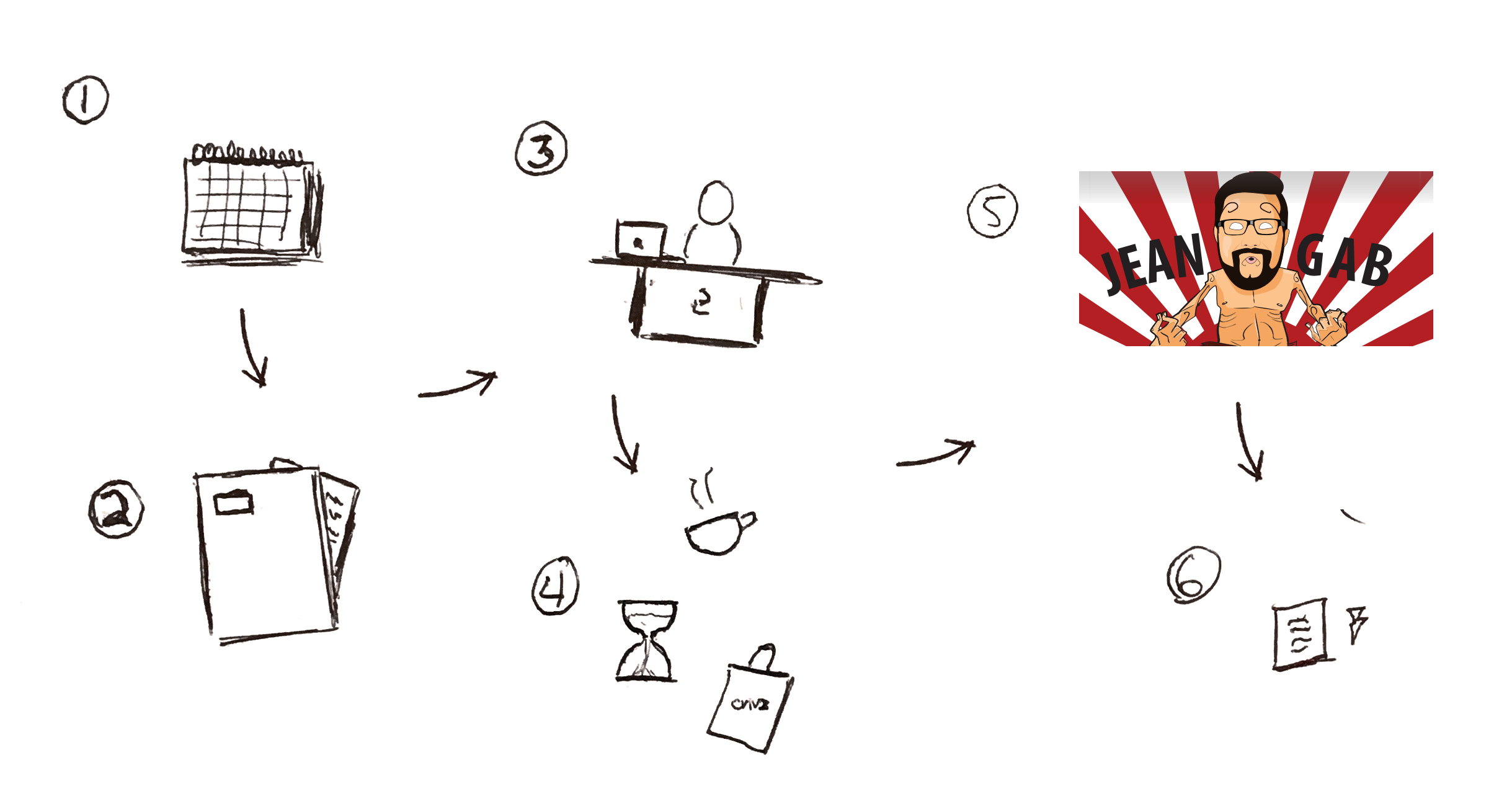

Here’s our new way of doing it:

1) You make an appointment now on this link in advance. The clinics will be held on Saturday, March 25 and Sunday, April 9.

2) You gather your documents with this list. Please note that you will be required to obtain the missing documents on the day of the clinic, so be sure to check carefully.

3) You arrive at the office at the time of your appointment. A nice receptionist (myself) will walk around your documents with you and give you an hour of return the same day to come back to sign your statement.

4) Aaron, Nathan or I will fill out your statement. You will need to be available on the phone to answer questions. Jean Gabriel will do the revision.

5) You meet our tax guru, Jean Gabriel, who will explain your tax situation.

6) You sign your papers, pay your bill and the statement is sent out immediately.

It is important to note that we will not file any returns outside these dates. Aside from clients who have hours of consultation banks, we will not answer questions or requests for additional support outside this period. If this solution is not satisfactory for you, we invite you to look for another alternative immediately for your personal taxes. Our colleague Philippe Gallo, CPA auditor, CA, will also be able to accommodate you. (https://www.impotpresto.com/).

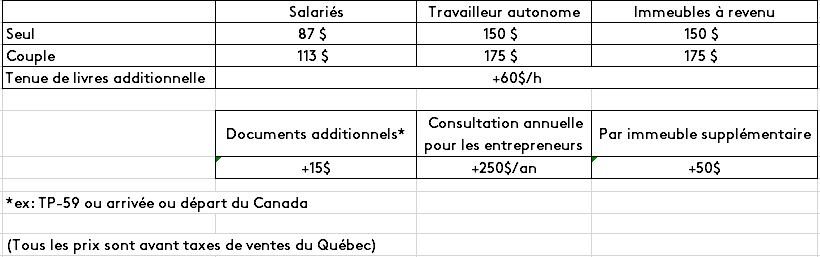

Here are our rates for the year 2016:

I invite you to contact us if you have any questions.

Thank you for your time, and see you soon!