Beginner’s Guide: Reading an Income Statement

Posted on July 10, 2017

Here is a revised version of an article published in 2014 on our website:

The Statement of Operations is an accounting summary of transactions over a period of time to determine whether a business has generated profits or losses. In short, these are the income minus the expenses of a business in the period. Although the statement of earnings is related to a company’s cash flow, it is a measure of accounting profitability and not its cash flow.

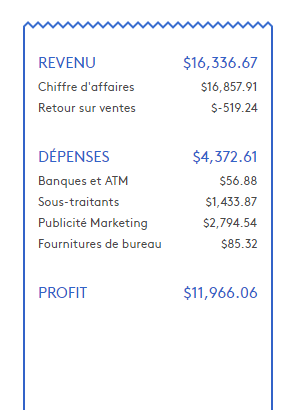

This report should have the attention of the contractor at least once a month. Here is a simplified example of a state of results, in the wild:

| Status of the results As at 31 December 20XX |

|

|---|---|

| Sales | $ 100,000 |

| Cost of goods sold | |

| Direct labor | $ 20,000 |

| Raw materials | $ 50,000 |

| Indirect costs | $ 5,000 |

| Gross Margin | $ 25,000 |

| Operating expenses | $ 20,000 |

| Earnings Before Tax | $ 5,000 |

| Tax | $ 1,000 |

| Net earnings | $ 4,000 |

Read the earnings statement

Generally, the first two glances will be used to look for two crucial elements: the top figure (sales) and the bottom figure (profits). By making a quick prorata, it is possible to know what is the net margin that a company releases on its sales. Reading the income statement will then be done from top to bottom to examine the various income and expense items. Here they are in order of appearance:

A- Income: Proceeds from sales

B- Cost of Goods Sold (CMV): These are the costs that are directly related to the products sold. The cost of labor to manufacture the product or to provide the service, raw material and related costs.

C- Gross margin: A – B

D- Operating expenses: These are all costs that are not included in the cost of goods sold.

E- Net Income Before Tax (EBT): C-D

F- Tax: The tax contribution of the company

G- Net Income: E-G

Some comments:

A profitable business is not necessarily a company that generates money

If the company invests its profits in its assets (equipment, buildings, inventories, accounts receivable), the company’s bank account may not reflect its profitability. Sometimes, high-growth companies are experiencing significant financial difficulties because they have to finance their activities. Equally, dividend payments to shareholders will not be reflected in the income statement.

Likewise, a loss-making business is not necessarily a business that lacks money.

Twitter was 7 years old in 2012 and had not yet made a dollar of profit, despite significant sales of $ 317M (1). The capital invested in the company far exceeded losses generated by the company, which allowed them to have enough money to continue operations.

Also, it should not be forgotten that the growth in the value of a company’s assets is not included in the statement of income. Thus, farmers, who have not made a profit for decades of hard work, can find themselves millionaires in retirement with the sale of their assets (land).

Shareholders are employees of their business

Many start-up business owners do not pay a salary and exclude this amount from the statement of income. The actual profit of a company must be considered after the remuneration of the directors.

Example: Two similar companies show their status to a banker. Which of the two companies is the most profitable?

| Company A | Company B | |

| Sales | $ 150,000 | $ 150,000 |

| Cost of sales | $ 90,000 | $ 90,000 |

| Rent | $ 20,000 | $ 20,000 |

| Directors’ salary | $ 40,000 | $ – |

| Profit net | $ – | $ 40,000 |

The two companies make as much profit if we consider that the net profit serves to remunerate the shareholders who are also the directors of the company. Most entrepreneurs do not count the number of hours they spend developing their business; People who would never accept a $ 5 / hour salary for their company. However, when we analyze the results of the companies, we must consider wages equivalent to the market for the same item to validate the profitability.

What does the entrepreneur look for in the statement of results?

Does the company make money?

The current profit (or loss) speaks volumes about the company’s ability to self-finance.

What is the gross margin?

Knowing the cost structure of a company makes it possible to know if it is profitable in the long term. We want to compare the gross margin of the sector. For every dollar of sales, how much profit does the company make?

What is the proportion of fixed versus sales?

Does the company sell enough to reach its break-even point (the level at which the company covers all its expenses with sales). Considering its gross margin, how many units should it sell to get there.

What proportion of expenditures is actively committed to earn an income?

A reflex of many entrepreneurs is to reduce spending when cash flows get tighter. The first expenses to fall are the easiest to reduce: advertising spending. However, these are the ones that bring water to the mill and pay all the fixed costs. A company that spends little on advertising often has an untapped potential to sell on the market.

Is the company in control of its expenses?

By analyzing spending items over months and years, it is possible to control spending on a prospective basis to ensure that it remains within the company’s capabilities.

To conclude

We sometimes find ourselves flabbergasted by the lack of attention paid to this report by some entrepreneurs, which ends up being relatively simple to understand and which can be used to give barriers that are often crucial for a company. If only to understand the interaction of external actors (bankers, investors, governments), it is pertinent to understand its functioning and its mechanisms.

(1) Robert Hof, IPO Filing: Twitter Still Losing Big Money Even As 2012 Revenues Tripled, Forbes, http://www.forbes.com/sites/roberthof/2013/10/03/revealed-in-ipo-filing-twitter-still-losing-big-money-even-as-2012-revenue-tripled-to-317-million/