La formule magique – Comment augmenter votre profitabilité en ligne à l’aide d’indicateurs

Rédigé le 21 avril 2020

With COVID – 19 wreaking havoc on businesses and consumers flocking to online ordering, many companies are pivoting their businesses to delivery or online content models .

For many companies, the archaic “spray-and- pray ” marketing technique still remains the only method used to increase their sales. We shoot blindly hoping to hit the target, without direct feedback on initiatives, without A/B tests and without a detailed understanding of growth vectors . However, online sales bring, thanks to the traceability of information, a new dimension to the analysis of financial data.

Without the resources of Amazon and the multivariable analyzes of companies that specialize in the field, it is still possible to do well , but you must first know what to look for . Here is the magic formula that will allow you to know if your online efforts are paying off or not :

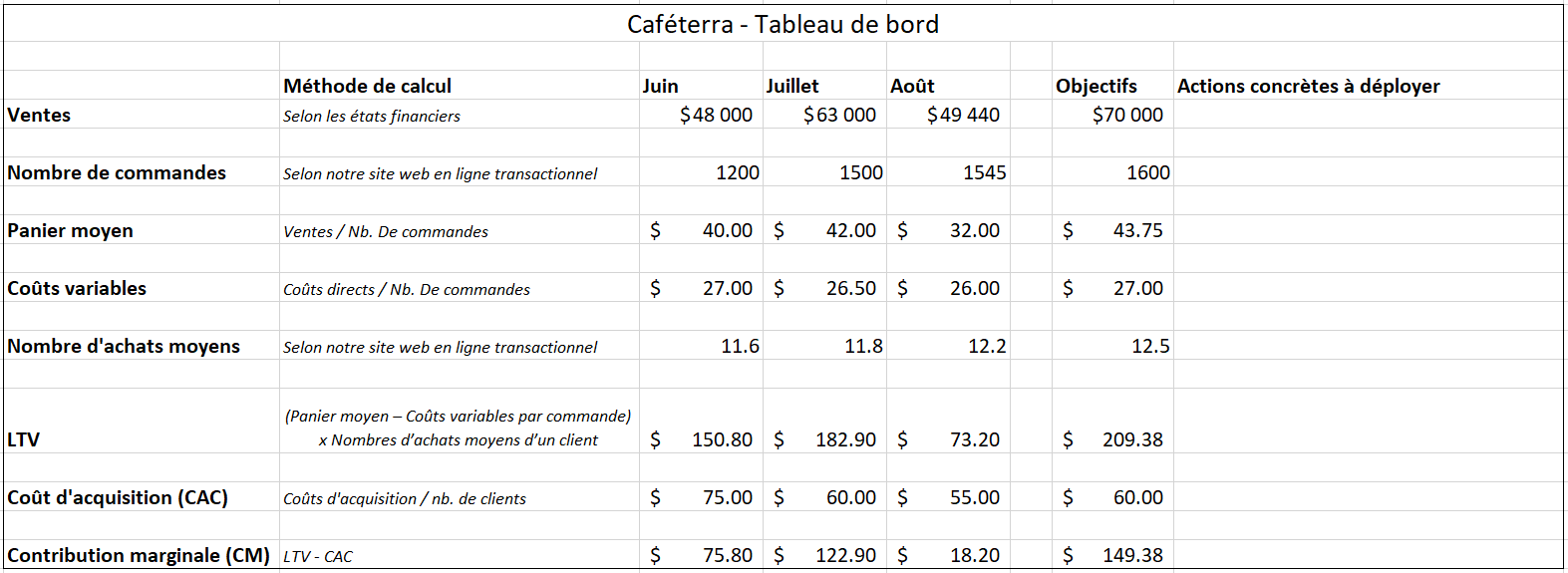

Spreadsheet to do the calculations

LTV – CAC = CM

This formula will allow us to calculate the marginal contribution of a customer to the business, and will allow us to better understand the efforts we must deploy in order to acquire it. Let’s deconstruct it together .

LTV = Customer Lifetime Value

The total value of a new customer. Each of your customers will purchase a given value from your products over the course of their relationship with your brand. Some users will only buy your product once, but others will use it repeatedly, depending on your ability to retain them. By understanding the total value of a consumer’s purchases, we will know how much we are willing to pay to acquire that customer. There are several ways to calculate this variable, but we will calculate the metric in different industries later in this text.

CAC = Customer Acquisition Cost

Once we know how much a customer makes for us, we need to understand how much it costs to get them to buy from us. It is possible to find out the average acquisition cost of a customer by dividing the amounts spent on marketing by the number of customers. That said, the more we are able to segment these efforts and understand what contributed to making an individual our customer, the better we can target our campaigns.

CM = Marginal contribution of a new customer

Subtracting these two indicators allows us to know our marginal contribution per customer. By multiplying marginal contribution by your number of customers, you will know the amount that will allow you to pay your rent, your administrative costs (especially your accountant!) and generate a profit.

Here are two examples of fictitious companies

A software company sells an online solution for $249 annually.

On average, 70% of customers renew at the end of the year.

LTV calculation

LTV = Average gross profit per sale x (Retention rate / (1 + discount rate – retention rate)) LTV = $435.75

LTV = $249 x (0.70 / (1 + 0.10 – 0.70))

Average gross profit per sale

For a software company , since marginal costs are often minimal, this is the selling price.

For other companies , it is the selling price minus manufacturing and distribution costs.

Discount rate

The interest rate calculated to determine the present value of future funds.

We’ll take the 10% rate for this example, but that’s generally the rate your business would pay for long-term financing.

Observation

On average , each new customer will bring $435.75 to the mill.

It is also the maximum that the company will be willing to pay to acquire this customer.

To increase its revenues,

this company can work on all the metrics that make up its LTV:

- Increase the selling price of your software

- Offer third parties according to the Good- Better -Best methodology

- Do geographic targeting (e.g .: customers pay more in the United States than in India)

- Increase retention rate

- Offer two-year subscriptions, or a renewal discount.

- Improve the product to increase its perceived value

- Increase customer loyalty by ensuring proper use of the software (e.g .: contact customers who do not use or misuse the software)

- Have impeccable customer service

CAC calculation

CAC of redistribution = (Rebates to the distributor + Support to distributors) / Number of new customers CAC = ((25% * 249 * 1000) + 150,000) / 1000 CAC = $212.25

Consider our software company, which discovered it had two clear acquisition channels for its software: third-party distribution and direct marketing. In its redistribution program, the company has two full-time employees ($150k) who find partners and give a 25% rebate to distributors when they sell a subscription to the software; 1000 pieces of software were sold this way in the last year.

Direct marketing CAC = (Fees + Media buys) / Number of new clients CAC = (50,000 + 300,000) / 2500 CAC = $140

For its direct marketing, the company does business with an external firm which costs it $50,000 in fees and $300,000 in media purchases for 2,500 subscriptions sold in the last year.

Global CAC = (CAC of redistribution*1000 + Fees + Media purchases) / Number of new clients

Global CAC = (212,250 + 350,000) / (1000+2500)

CAC = 160.64

We see that the company could place greater emphasis on direct marketing since this measure costs it less than working with distributors.

Calculation of the CM

LTV – CAC = CM 435.75 – 160.64 = $275.11

For every dollar invested in business growth, it is multiplied 2.75 times over time. The limiting factor, at this level, is often that the money made from sales will be collected later, since it is over the life of a consumer that we will get paid. With indicators like this, the company would benefit from obtaining financing or even raising capital in order to accelerate sales

Consider a roaster that sells its coffee online. On average, a consumer purchases $40 worth of product online, for a product that costs the company $20 to produce. Added to this are delivery fees of $6 and $1 transaction fees. We know, thanks to the company’s CRM, that a customer orders coffee with us on average 11.6 times before stopping.

LTV calculation

LTV = ( Average basket – Variable costs per order) x Average number of purchases of a customer LTV = (40 – (20+6+1)) x 11.6 LTV = $150.80

Average basket

Online revenue / Number of orders

Variable costs per order

Gross manufacturing margin + Delivery costs + Transaction costs .

Observation

A customer brings us an average of $150.80 .

In order to be more profitable,

this company will be able to play on all the metrics that make up its LTV:

- Increase a customer’s average basket

- Offer promotions (e.g .: free delivery on purchases over $60)

- Make sets (offer a gift basket or suggest basket compositions)

- Incentivize add-ons and cross-sell (would you like to have a Youpi! autographed mug in addition to your coffee?)

- Reduce your variable costs

- Generate better margins by working on your cost structure

- Offer the customer the opportunity to pick up their order

- Increase a customer’s average number of purchases

- Re-target customers who have already purchased with marketing (e.g. newsletter , promotions)

- Improve the perceived value of coffee to increase customer retention .

- Suggest a subscription plan .

- Better target the types of customers who are more loyal and who spend more during acquisition by segmenting them.

Obviously, the more acquisition channels are put in place, the more difficult it will be to separate acquisition costs by channel. We must not forget that direct marketing promotional activities have a positive impact on distribution sales, which is not captured by our segmentation.

To reduce its acquisition cost, the company can:

- Carry out A/B tests on your different campaigns to see which ones convert better

- Better target your advertising to only target customers who convert best

- Support your online campaigns with other advertising by doing cross-marketing.

- Building an organic acquisition channel (content marketing , influencer marketing)

- Automate sales and marketing processes

Calculation of CAC

Our coffee company has only one way to acquire its consumers: by advertising on social media.

His team of 3 people ($175k) managed , with a budget of $50,000, to attract 3000 new clients in the last year.

Direct marketing CAC = (Fees + Media buys) / Number of new clients

CAC = (175,000 + 50,000) / 3000 CAC = $75

Calculation of the CM

LTV – CAC = CM 150.80 – 75 = $75.80

Online commerce is often about volume. To pay the salary of a new person in the organization ($60k), you have to get 791 new clients (60,000 / 75.80)! Luckily, an online strategy is easier to operationalize, since we don’t have to manage multiple locations and we can centralize operations in one location.

To conclude

A company selling online should keep its eyes on the components of this formula monthly, just as it should read its monthly results in its financial statements. It is possible to automate the calculation of this and discuss these metrics with your marketing team, they should know these indicators by heart! Having a quantitative approach will allow them to better align efforts and, above all, to fully understand the impacts of their actions on the company’s profitability.

To this, I add a few additional comments :

- Theoretically, you should spend more to acquire a customer (CAC) as long as your marginal contribution (MC) is greater than 0. This is true for software companies or if you have production capacity greater than your sales. Remember that it is rare that an increase in sales does not lead to a possible increase in fixed costs.

- The unit marginal contribution has an impact on the total marginal contribution, and it is with this that we will pay our fixed costs. One must also think about the net impact of an increase in sales on the total marginal contribution to make an informed business decision.

- With most of our clients, I see a glaring disparity between media spend (display, pay -per-click) and fixed marketing costs (salaries, salespeople). For example, a company will spend $20,000 per month on its employees and $5,000 on its advertising. Unless organic content generates a lot of sales, this makes no sense! The old adage in advertising is the 80/20 rule (80% media spend , 20% fixed costs), but each industry has its own fundamentals . I invite you to think about what really brings grist to the mill.

- Some, like me, advise you to incorporate your desired profitability (eg : 20 % ) into your acquisition cost. “Mo’ money mo’ problem ”, then there is no point in increasing sales if they do not pay off.

- It is a formula, obviously, which also applies to traditional industry, but its application is much more complicated to implement for these reasons:

- Lack of precise data on consumer behavior

- Traditional marketing methods (television, print, radio, etc.) make cost segregation more difficult

- Difficulties deploying tests to improve metrics

- The target CM strongly depends on the industry in which you work. It is always better to compare ourselves to our past results or desired results. I recommend that you monitor this indicator monthly to see an idea of the consequences of your initiatives. Remember, your CM should almost always be positive, otherwise you are losing money!

That’s it, you are now ready to do online witchcraft using this magic formula for your business, and take the corresponding actions to improve its components. Do not hesitate to use our online spreadsheet to make your first calculations.

Articles consulted for the writing of this article:

https://blog.hubspot.com/service/how-to-calculate-customer-lifetime-value

https://neilpatel.com/blog/customer-acquisition-cost/